Life Care Plans often lay the financial framework for proving future medical needs but are often widely disputed. Having a quality Life Care Plan evaluated by a quality economist can play a large role in jury trials but seldom carries the same weight at settlement discussions/mediations. The reasons for this unequal treatment have much to do with the fact that Life Care Plans can be biased, overblown, and are subject to myriad economic (i.e., Discount Rate/Interest Rate) and non-economic (i.e., life expectancy) assumptions. But if the case isn’t headed for trial and settlement discussions are desired, using a structured settlement specialist can help quantify future Life Care needs more clearly for both sides.

To be sure, some Life Care Plans contain hundreds of medical services, supplies, therapies, drugs, devices and many other non-medical needs (i.e. transportation, home modifications, etc.). Many of those items are relatively small and need not be individually reduced to “present value” when using an annuity to “price out” a Life Care Plan. Typically, though, a Life Care Plan will have a limited number of big-ticket items which often represent the biggest stumbling block to meaningful settlement discussions. Perhaps the biggest item is the type of care (i.e., Custodial/Semi-Skilled/Skilled) suggested by the Life Care Plan.

Assuming the parties can reach agreement on which type of care is likely needed, how often it is needed, and the current market cost for said care, the question often comes down to how much will that stream of payments actually cost. Competing economists will argue one way or the other at trial, depending on which side of the table hired them. But pricing out what it would cost to provide an annuity that would guarantee those payment streams, at a reasonably assumed inflation rate, will show both sides what it would actually cost to fund those needs.

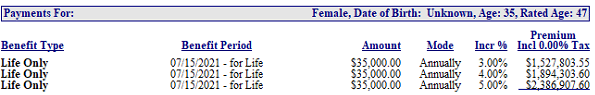

For example, consider Mary is 35 years old and suffered a horrific C2 spinal cord injury. Her Life Care Plan shows she will need $35,000 per year for the rest of her life to provide the type of medical care needed to life in her own home. Knowing that Mary will probably not live a normal life expectancy, her attorney, Sarah, obtained a Rated Age of 47 from her structured settlement specialist. Sarah can now go into settlement discussions knowing that this singular component of the Life Care Plan she intends to use if the case goes to trial has a cost range of $2,386,908 to $1,527,803 depending on what inflation rate one assumes.

The parties can now agree or disagree on this singular, yet significant, economic item. But if the parties are serious about settling, establishing a factual argument on the cost to fund a future medical need can go a long way towards reaching a reasonable settlement value. Of course, Rome wasn’t built in a day so the structured settlement specialist will often requote various Life Care Plan needs to assist Sarah in settlement negotiations.